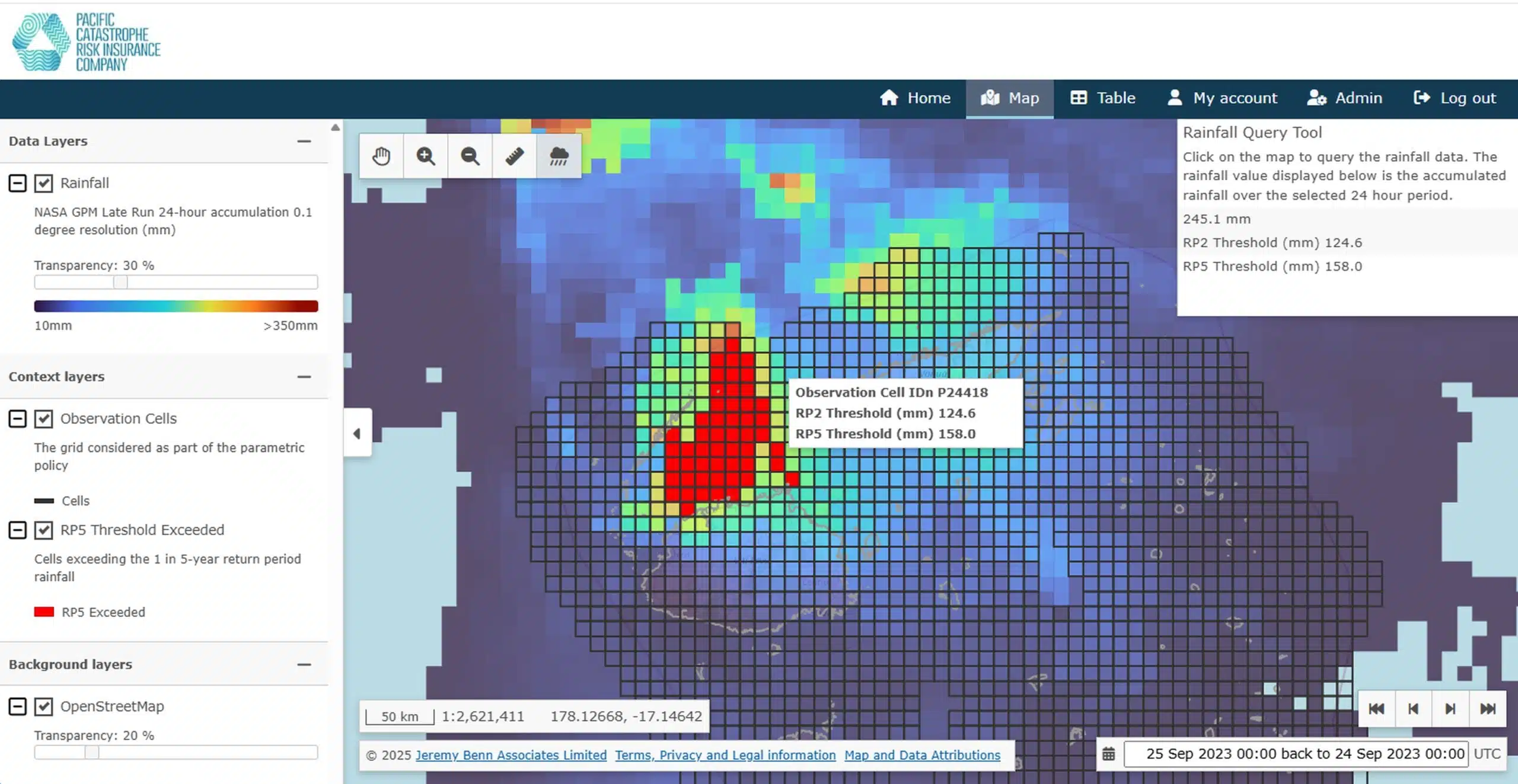

We supported the Pacific Catastrophe Risk Insurance Company to design a sovereign parametric insurance product for excess rainfall events, strengthening financial resilience across 14 Pacific Island Countries. The product uses advanced rainfall modelling to trigger rapid post-disaster funding and support economic stability.